Time Series Analysis Using ARIMA From Statsmodels

ARIMA and exponential Moving averages are two methods for forecasting based on time series data. In this notebook, I will talk about ARIMA which is an acronym for Autoregressive Integrated Moving Averages.

Autoregressive Integrated Moving Averages (ARIMA)

The general process for ARIMA models is the following:

- Visualize the Time Series Data

- Make the time series data stationary

- Plot the Correlation and AutoCorrelation Charts

- Construct the ARIMA Model or Seasonal ARIMA based on the data

- Use the model to make predictions

Let's go through these steps!

Monthly Champagne Sales Data

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

%matplotlib inline

For this example, I took the sales data which is available on kaggle https://www.kaggle.com/anupamshah/perrin-freres-monthly-champagne-sales

df=pd.read_csv('perrin-freres-monthly-champagne-.csv')

df.head()

df.tail()

## Cleaning up the data

df.columns=["Month","Sales"]

df.head()

Our objective is to forecast the champagne sales.

## Drop last 2 rows

df.drop(106,axis=0,inplace=True)

Axis=0, means row. Learn more about dropping rows or columns in Pandas here

df.tail()

df.drop(105,axis=0,inplace=True)

df.tail()

# Convert Month into Datetime

df['Month']=pd.to_datetime(df['Month'])

df.head()

df.set_index('Month',inplace=True)

df.head()

df.describe()

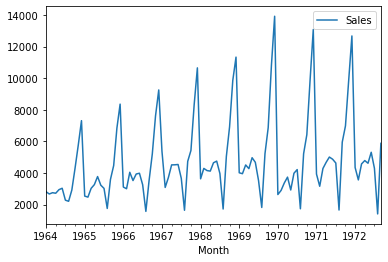

df.plot()

Stationary data means data which has no trend with respect to the time.

### Testing For Stationarity

from statsmodels.tsa.stattools import adfuller

test_result=adfuller(df['Sales'])

#Ho: It is non stationary

#H1: It is stationary

def adfuller_test(sales):

result=adfuller(sales)

labels = ['ADF Test Statistic','p-value','#Lags Used','Number of Observations Used']

for value,label in zip(result,labels):

print(label+' : '+str(value) )

if result[1] <= 0.05:

print("P value is less than 0.05 that means we can reject the null hypothesis(Ho). Therefore we can conclude that data has no unit root and is stationary")

else:

print("Weak evidence against null hypothesis that means time series has a unit root which indicates that it is non-stationary ")

adfuller_test(df['Sales'])

Differencing helps remove the changes from the data and make data stationary.

df['Sales First Difference'] = df['Sales'] - df['Sales'].shift(1)

df['Sales'].shift(1)

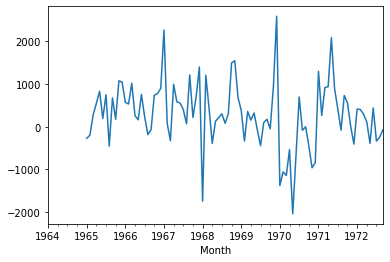

we have monthly data so let us try a shift value of 12.

df['Seasonal First Difference']=df['Sales']-df['Sales'].shift(12)

df.head(14)

Let us check if the data now is stationary.

## Again test dickey fuller test

adfuller_test(df['Seasonal First Difference'].dropna())

df['Seasonal First Difference'].plot()

from statsmodels.tsa.arima_model import ARIMA

import statsmodels.api as sm

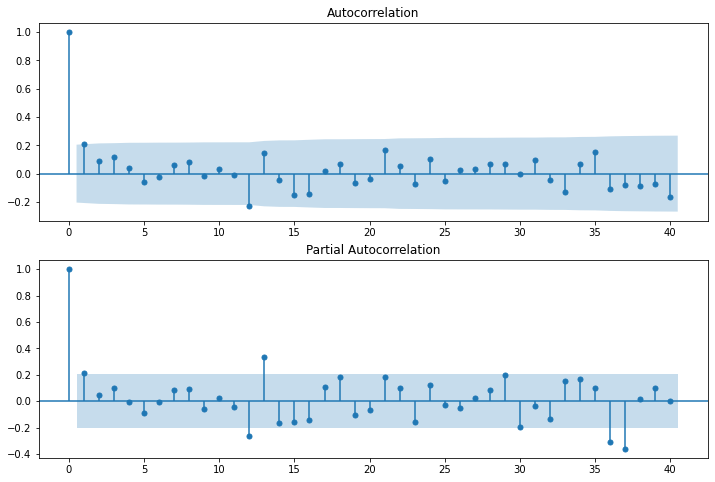

- Partial Auto Correlation Function - Takes in to account the impact of direct variables only

- Auto Correlation Function - Takes in to account the impact of all the variables (direct + indirect)

Let us plot lags on the horizontal and the correlations on vertical axis using plot_acf and plot_pacf function.

from statsmodels.graphics.tsaplots import plot_acf,plot_pacf

fig = plt.figure(figsize=(12,8))

ax1 = fig.add_subplot(211)

fig = sm.graphics.tsa.plot_acf(df['Seasonal First Difference'].iloc[13:],lags=40,ax=ax1)

ax2 = fig.add_subplot(212)

fig = sm.graphics.tsa.plot_pacf(df['Seasonal First Difference'].iloc[13:],lags=40,ax=ax2)

In the graphs above, each spike(lag) which is above the dashed area considers to be statistically significant.

# For non-seasonal data

#p=1 (AR specification), d=1 (Integration order), q=0 or 1 (MA specification/polynomial)

AR specification, Integration order, MA specification

from statsmodels.tsa.arima_model import ARIMA

model=ARIMA(df['Sales'],order=(1,1,1))

model_fit=model.fit()

model_fit.summary()

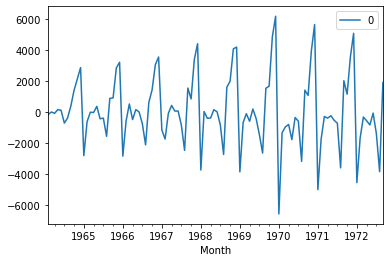

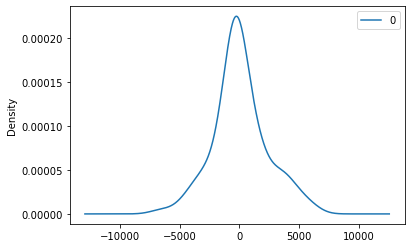

We can also do line and density plot of residuals.

from matplotlib import pyplot

residuals = pd.DataFrame(model_fit.resid)

residuals.plot()

pyplot.show()

# density plot of residuals

residuals.plot(kind='kde')

pyplot.show()

# summary stats of residuals

print(residuals.describe())

As we see above, mean is not exactly zero that means there is some bias in the data.

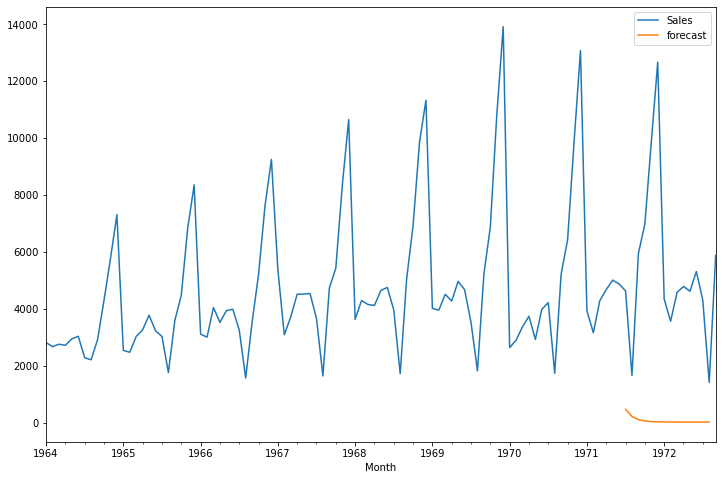

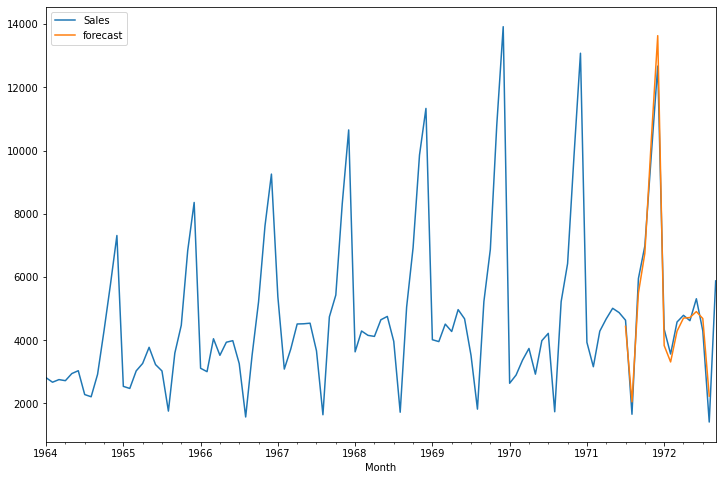

df['forecast']=model_fit.predict(start=90,end=103,dynamic=True)

df[['Sales','forecast']].plot(figsize=(12,8))

If you observe the above, we are not getting good results using ARIMA because our data has seasonal behaviour, So let us try using seasonal ARIMA.

import statsmodels.api as sm

model=sm.tsa.statespace.SARIMAX(df['Sales'],order=(1, 1, 1),seasonal_order=(1,1,1,12))

results=model.fit()

Note above the seasonal_order tuples which takes the following format (Seasonal AR specification, Seasonal Integration order, Seasonal MA, Seasonal periodicity)

results.summary()

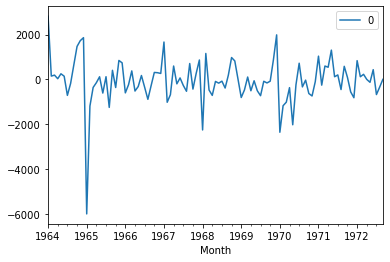

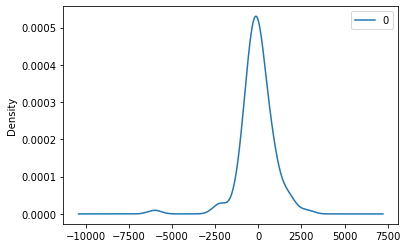

Let us plot again line and density chart of residuals.

from matplotlib import pyplot

residuals = pd.DataFrame(results.resid)

residuals.plot()

pyplot.show()

# density plot of residuals

residuals.plot(kind='kde')

pyplot.show()

# summary stats of residuals

print(residuals.describe())

df['forecast']=results.predict(start=90,end=103,dynamic=True)

df[['Sales','forecast']].plot(figsize=(12,8))

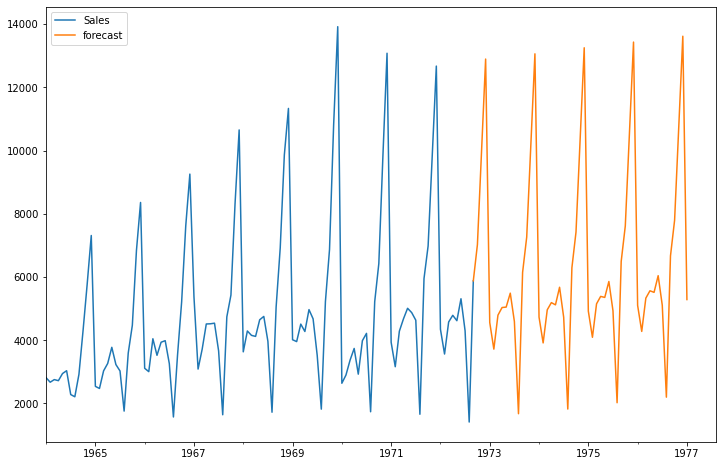

Conclusion: If you compare the ARIMA and SARIMA results, SARIMA gives good result comapre to ARIMA.

5*12

from pandas.tseries.offsets import DateOffset

future_dates=[df.index[-1]+ DateOffset(months=x)for x in range(0,60)]

future_datest_df=pd.DataFrame(index=future_dates[1:],columns=df.columns)

future_datest_df.tail()

future_df=pd.concat([df,future_datest_df])

future_df['forecast'] = results.predict(start = 104, end = 156, dynamic= True)

future_df[['Sales', 'forecast']].plot(figsize=(12, 8))

Related Notebooks

- Stock Sentiment Analysis Using Autoencoders

- Tweet Sentiment Analysis Using LSTM With PyTorch

- Stock Tweets Text Analysis Using Pandas NLTK and WordCloud

- Data Analysis With Pyspark Dataframe

- Opinion Mining Aspect Level Sentiment Analysis

- Calculate Stock Options Max Pain Using Data From Yahoo Finance With Python

- Remove An Item From A List In Python Using Clear Pop Remove And Del

- How to Generate Embeddings from a Server and Index Them Using FAISS with API

- Return Multiple Values From a Function in Python